DISTINCTIVE ACCESS

Our offer to Limited Partners:

ACCESS TO A WIDE PIPELINE OF DEALS

CCP board members have a deep personal network and reputation in the PE / VC industry providing them access to both household name large PE Houses as well as smaller niche players

INVESTMENT APPROACH

Our generalist approach (investment in a broad range of sectors and stage) and wide network allows each LP to implement his/her investment strategy according to his/her personal interest and risk/reward expectations

DUE DILIGENCE SERVICES

CCP performs an in-house due diligence for each investment proposal. If approved by CCP’s Investment Committee, the investment opportunity is summarized in an investment memorandum and presented to LPs

ALIGNMENT OF INTERESTS

All investment opportunities require the unanimous vote of all 5 members of CCP's Investment Committee. For any investment to be implemented, one or several of the 5 Partners will also commit to invest

COMPETITIVE

FEES

CCP is committed to keeping a lean organizational structure and low cost base which enables it to offer a competitive management fee and carried interest framework

A ROBUST GOVERNANCE

CCP is a registered Alternative Investment Fund Manager (‘AIFM’) as per article 3.2. of the Luxembourg law of 12 July 2013 on alternative investment fund managers which is registered with the Luxembourg financial services supervisory authority (CSSF)

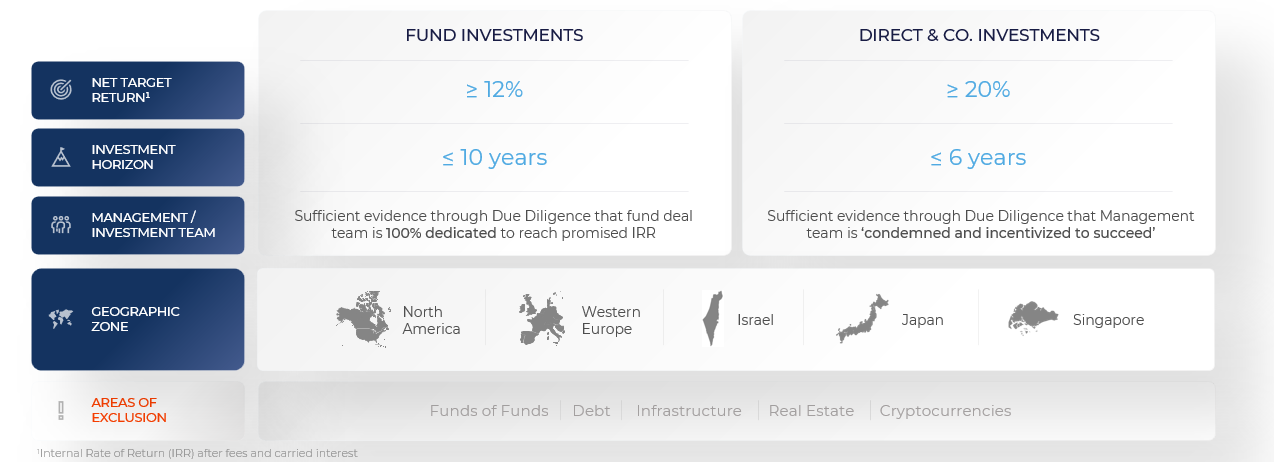

Our investments criteria:

Private Equity fund investments

Net target return: ≥ 12%

Investment horizon: ≤ 7 years including extensions

Geographic zone: North America, Western Europe, Israel, Japan, Singapore

Areas of exclusion: Funds of funds – Cryptocurrencies

Direct & Co-investments

Net target return: ≥ 20%

Investment horizon: ≤ 6 years

Geographic zone: North America, Western Europe, Israel, Japan, Singapore

Areas of exclusion: Funds of funds – Cryptocurrencies